Summary of Charter of demand for 11th Bipartite Settlement

Charter of demand for 11th Bipartite Settlement has been submitted jointly by AIBOC, AIBOA, INBOC & NOBO. This 11th BPS Charter of demand will be the basis for discussions and negotiations for finalizing the salaries, benefits and other matters concerning bank employees. The charter of demand for wage revision is 104 pages long. So we are providing you the summary of this charter of demand for bankers due from 1st November 2017.

[rad_rapidology_inline optin_id=optin_1]

See: How much time previous BPS have taken and SBI mandate for 11th bps for upto Scale – III only.

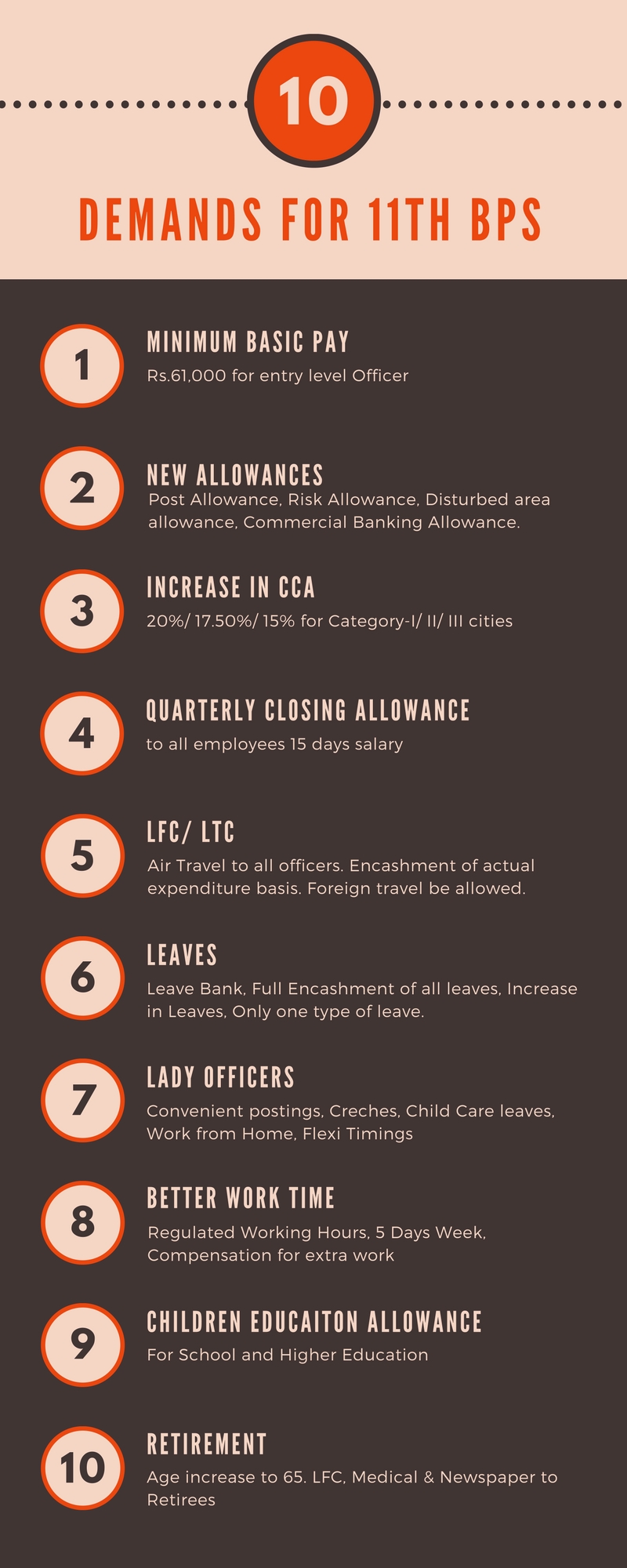

We have given the details of the demands for next bps in separate article, but following are the important points of the demands or you can say this is the crux:

- Minimum Basic Salary of Bank Officers is proposed at Rs.61000.

- Expected pay scale for 11th bipartite settlement of will be on the principles of 7th

- Entire D.A. outstanding as on 31.10.2017 to be merged with the existing Basic Pay

- Revised D.A. from 01.11.2017, for every four points of index over November 2017 index to be recalculated @ 0.07% per slab of 4 points.

- Self-leasing of own houses should be permitted

- Categorization of cities for CCA

- CCA @20%/ 17.50%/ 15% for Category-I/ II/ III cities

- Incentives for working in Rural Centers and other sensitive areas 20%

- Quarterly Closing allowance to all employees 15 days salary

- Running scale without stagnation be allowed

[irp posts=”2325″ name=”9 Useful Excel Tips for Bankers”]

- Introduction of Post Allowance, Risk Allowance, Disturbed area allowance, Commercial Banking Allowance.

- Switch to previous scheme for Reimbursement of 100% hospitalization expenses for family members.

- LFC- Air Travel to all officers. Encashment of actual expenditure basis. Foreign travel be allowed within ceiling.

- Convenient postings for lady officers

- Provision of crèche facilities

- Child care leaves.

- Paternity leave increase to 60 days.

- Work from Home and Flexi time scheme.

- Full pension after service of 20 years.

[irp posts=”2314″ name=”RBI puts restriction on IDBI Bank as Prompt Corrective Action”]

- Full encashment of leaves without ceiling.

- Medical benefits and LFC to retirees

- Regulated working hours

- 5 days week in banking

- Compensation for extra work

- Increase in leaves & introduction of leave bank.

- Do away with different types of leaves.

- Encasement of all leaves.

- Introduction of Administrative Tribunal

- Age of superannuation be increase to 65 years.

[irp posts=”2307″ name=”Bank to pay Rs.1 lac for not informing Rejection of Loan”]

- Education allowance for school and higher education of children.

- Income criteria for Dependents be increased to Rs.30,000

- Housing loan limit to Rs.1 core at Simple rate of interest without any slab, which can be repaid up to the age of 75.

- Car Loan limit to Rs.15 Lacs and Two Wheeler Loan limit to Rs.1 lac at Simple rate of interest without any slab.

- Review of all loans and advances and make same rules in all banks.

- Road tax on vehicles of different States should be paid by the bank on inter-state transfers.

- To meet additional expenditure towards education of children, housing etc., officers should compensated.

These are excerpts from the Detailed (Original) Charter of Demand for 11th bipartite settlement by the AIBOC, AIBOA, INBOC & NOBO.

5 Comments

V NARAYANA MURTHY · July 7, 2017 at 1:13 pm

Very good. Once can enjoy by reading. But to what extent the unions will stick the demands and clinch the settlement is to be seen.

It should happen like asking for moon and accepting peanuts, like in earlier settlements.

Good luck

V NARAYANA MURTHY · July 7, 2017 at 1:15 pm

Last sentence read as “it should NOT happen”

Rahul Uniyal · July 20, 2017 at 9:13 am

Wishing this could actually be possible, I am not as optimistic about these demands but minimum basic pay should be around 50k+ and allowances should increase. The most important point is compensation for extra time but sad thing is that won’t be happening in near future.

Anonymous · August 12, 2017 at 9:29 pm

Bankers DA. Is not increasing especially after 10 Bipertite settlement in new settlement DA to be at central rates or slab to be atleast 15 pause

TUKARAM K TURE. · May 16, 2019 at 12:10 pm

Long pending demands of Pensioners should be considered in perspective way such as 1)Updation of pension 2)DA to be applicable quarterly 3) Increase in in family pension.

Comments are closed.