What are current assets and what are current liabilities and how to identify in balance sheet.

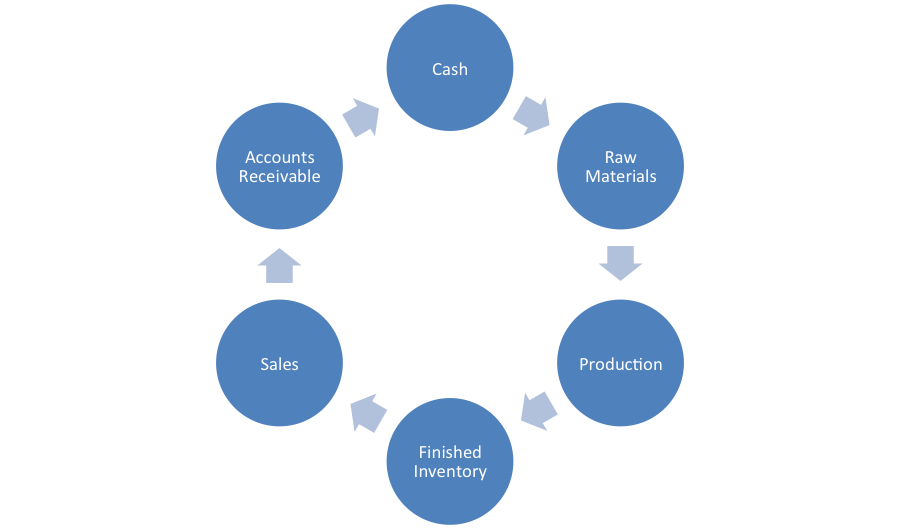

Current Assets are the assets which can be converted in cash within a short period of time (not more than one year). There are some assets, which can be disposed to generate cash immediately, which are known as liquid assets and some other which are held to generate cash within some time (within one year) but not immediately.

Also Read : What is working Capital?

Technically, current assets are those assets, which satisfies the following conditions:

- it is expected to be realised, or is intended for sale or consumption, in the company’s normal operating cycle; or

- it is held primarily for the purpose of being traded; or

- it is expected to be realised within twelve months after the reporting date; or

- it is cash or cash equivalent unless it is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting date.

Components of current assets

- Cash (obviously)

- Balances with Banks (current accounts, saving accounts, credit balance is OD/ CC accounts)

- Fixed deposits with banks (these may be of maturity period over one year but practically, these can be liquidated any time to get cash)

- Stocks of Raw Material, Work in Process and Finish Goods (selling of this asset is business of the organization)

- Stocks of spares and consumables (these are not held for sale but consumed in production and are not held for long term)

- Goods in transit

- Receivable or Debtors (sales made on credit for which payment is yet to be received)

- Short term loans and advances (it is difficult to identify, which advances are short term in nature and which are not. So it is important to drill down and see the specific components of this item to see if it is current or non current)

- Advances to suppliers

- Other current assets

- Advance tax paid and TDS

- Income Tax refundable

- VAT/ Excise/ Service Tax Credit receivable

- Prepaid expenses

- Advances given for expenses

- Short term security deposits

- Interest accrued on FDRs

- Other incomes receivable such as rent receivable

Also Read: Analysis of Holding Period for working capital assessment

Current Liabilities

Current Liabilities are those liabilities, which are to paid within a period of one year. Technically, a liability is to classified as current if:

- It is expected to be settled in the company normal operating cycle; or

- It is held primarily for the purpose of being traded; or

- It is due to be settled within twelve months after the reporting date; or

- The company does not have an unconditional right to defer settlement of the liability for least twelve months after the reporting cm Terms of a liability that could, at the option the counterparty, result in its settlement by the issue of equity instruments do not affect its classification.

Components of Current Liabilities

- Trade Payables/ Creditors (purchases for which payment is yet to be made

- Creditors for expenses

- Cash Credit/ Overdraft from banks

- Other short term loans

- Debt balance in current/ saving accounts

- Income received in advance

- Duties and taxes payable

- Expenses payable

- Provision for Income Tax

- Interest accrued but not due on borrowings

- Unpaid dividend

- Unpaid matured deposits

- Share application money, which is to be refunded

- Current Maturities of long term debts (This is the amount, which is the portion of long term borrowings, which is payable within one year from the balance sheet date. Generally, this is not shown in balance sheets, except in case of companies, so if there are long term borrowings, installments payable within one year should be separated)

You may like : How Assessment of Term Loan is done?

What is the disadvantage of wrong classification of current assets and liabilities?

Current Asset wrongly classified as Non Current OR Non Current liability wrongly classified as Current

In this case, the working capital of the organization is wrongly calculated on lower side. This will wrongly lower the current ratio.

Non Current Assets wrongly classified as Current OR Current liability wrongly classified as Non Current

In this case, working capital will be wrongly calculated on higher side and will wrongly depict a higher current ratio

To understand what is working capital and it is calculated, read this article.