Analysis Of Holding Period : How to : Ultimate Guide

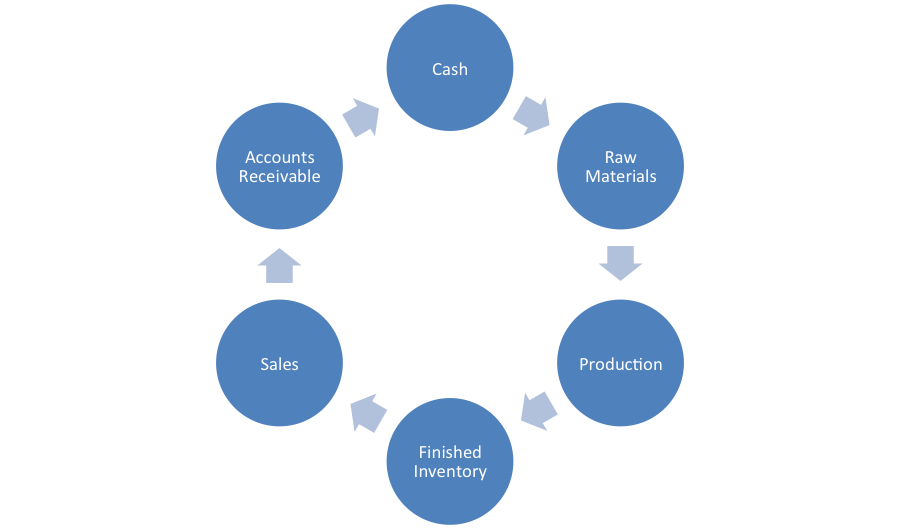

Analysis of holding period is an important aspect while sanctioning working capital facilities in Banks. In this article, we have discussed how holding periods are calculated and analysed for stocks, receivables and creditors.

Holding levels means the period of a particular current asset or current liability after which it is converted or realized or is paid. To understand this, we will discuss it one by one:

To understand what is working capital – Read this article.

Also Read: Simplified Turnover Method for working capital assessment

Stock Holding Levels or Inventory Holding Levels

How is it calculated?

Raw Material holding level (in months) = Average stock of Raw Material x 12 / Raw Material Consumed

Average stock of raw material = (Closing + Opening Raw Material stock)/ 2

For e.g. if opening stock is 40 crores and closing stock is 60 crore and purchases are 100 crores, how to calculate raw material holding period?

First calculate raw material consumed = opening stock + purchases – closing stock (40+100-60 = 80)

Now calculate average stock of raw material = (40+60)/2 = 50

Now calculate raw material holding period = 50×12/ 80 = 7.50 months.

It implies that the on average basis the organization holds the raw material which will be consumed in 7.50 months or in other words it takes 7.50 months to convert the raw material into work in process.

Now you should be able to understand that which entity is better, one having raw material holding of 2 months and other having raw material holding of 7.50 months. Obviously, the one which is having lower holding period, because, that one is converting the raw material into stock in process and which is converted in finished goods and finally sold, which means that you receive cash, quickly if you process raw material quickly.

You understand that more quickly the raw material is converted in cash, lesser the capital requirement (or say lesser requirement of long term funds) for holding huge stocks of raw material.

Similarly, Stock in process holding period is calculated as:

Average stock in process x 12 / Cost of production

Now, you know how to calculate average stock in process and need not to be explained. Cost of production is calculated as under:

Raw material consumed (i.e., opening raw material + purchases – closing raw material)

Add: Power & fuel

Add: Direct labour (labour used in factory)

Add: Other manufacruing expenses

Add: Depreciation

Add: Opening stock in process

Less: Closing stock in process

Suppose the stock in process holding period is 3 months. It indicates that the work in process takes 3 months to be converted in finished goods or in other words stocks in process of 3 months is held by the entity, which means that the entity require funds to hold that much of stock in process.

Finished Goods holding period = Average stock of finished goods x 12 / Cost of sales

Cost of sales = cost of production + opening stock of finished goods – closing stock of finished goods.

Suppose the finished goods holding period comes out 2.50 months. It implies that it takes 2.50 months to sell the finished goods or in other words, finished goods are held for 2.50 months.

You may also like this – Assessment of Term Loan

Receivables holding period

Receivables (Debtor) holding period (or debt collection period) depends upon the credit period allowed by the organization. So, if the organization sell goods on 3 months credit, receivables holding period will be 3 months.

How is receivables holding period (debt collection period) calculated:

Average receivables (debtors) outstanding x 12 / Gross sales

Average receivables = (opening receivables + closing receivables)/ 2

Some suggest to divide average receivables by gross credit sales instead of gross sales, but I personally feel that as an outsider, it not feasible to know credit sales and also since, we are calculating holding period on average basis, we consider gross sales.

Creditor payment period/ Creditors Holding Period

Creditors payment period is the period within which the creditors are paid. This is the credit period allowed to an entity by its creditors from where raw material is purchased.

This is calculated similar to Debtor collection period.

= Average creditors x 12 / Purchases

So as already explained, lesser the better. Lesser holding periods lesser operating cycle, which means conversion of raw material to cash quickly.

You may like this too – List of finacle commands