Public Credit Registry: A New Repository of Credit Information by RBI

The Reserve Bank of India is of the opinion that in its attempt to take care of the rising NPA problems it should form a separate repository of information of borrowers so that there is detailed data of any borrower with the regulator. With this concept, the idea of the Public Credit Registry was floated by the Reserve Bank of India and it also appointed the YS Deosthalee Committee to recommend regarding the finer issues concerned with this idea. YS Deosthalee is the former CMD of the L & T Finance Holdings Limited and he was assisted by nine other members in the committee. The terms of reference of this committee were to study the international best practices regarding the Public Credit Registry and also the present available information on credit in India so that the proposed repository can fill the void in the present system of maintenance of information regarding borrowers and especially defaulters. The committee was formed by the RBI in December 2017 and it submitted the report in April 2018.

Read: 30 months is the the Average delay in bank wage revision

Read: Possibilities of 5-Day Banking in India

Existing structure of credit information in India

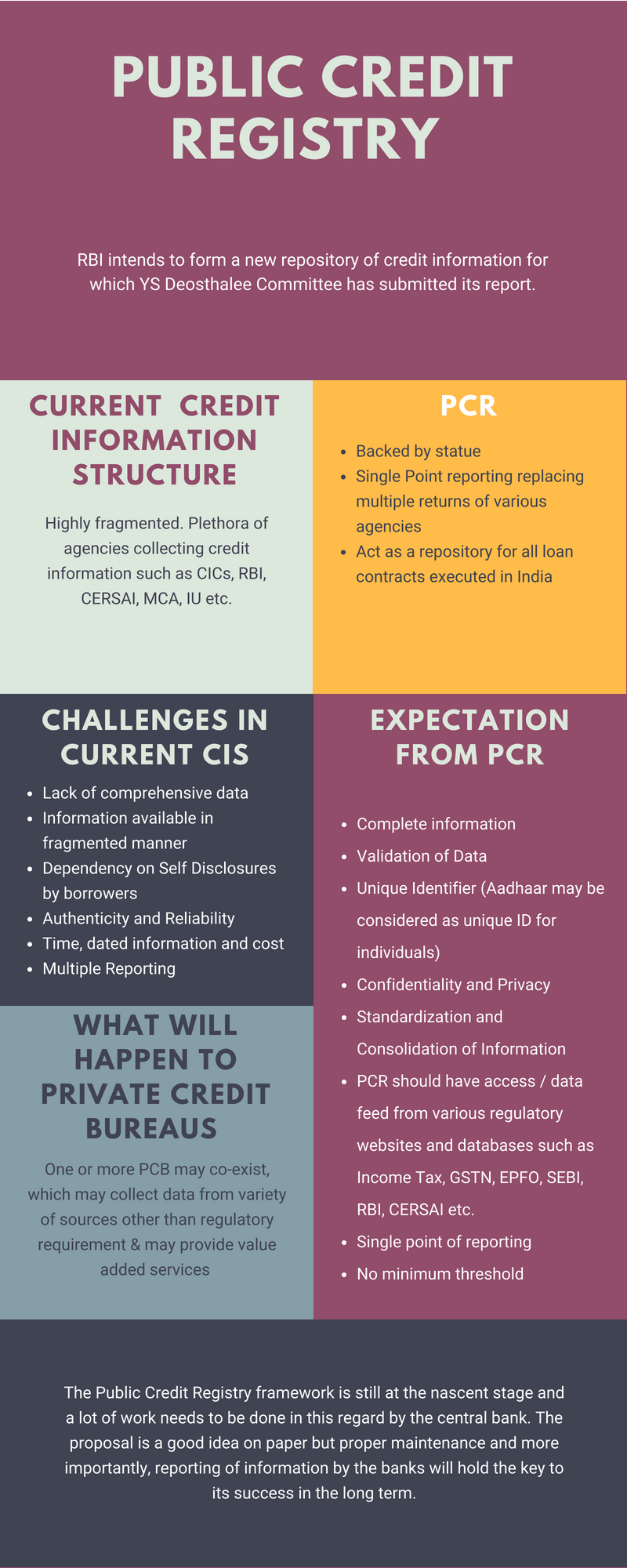

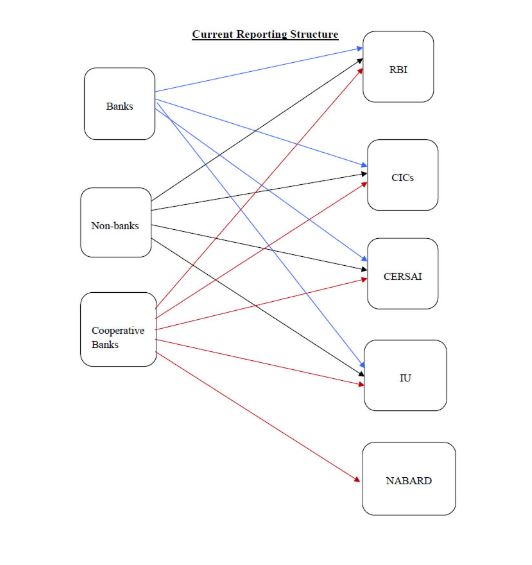

The existing structure for collection of Credit data in the country is highly fragmented. There is a plethora of agencies collecting credit information in the country. Prominent agencies which collect credit data in the country include Credit Information Companies, Reserve Bank of India, CERSAI, Information Utility, etc. There are other agencies also collecting data important for credit decision making, e.g. MCA.

What is a Public Credit Registry?

A Public Credit Registry is a repository of information that keeps extensive credit data that is accessible to all the stakeholders. It will identify the good borrowers and the bad borrowers and will also offer lower interest rate to the good borrowers. The PCR will also help the MSME sector to get loans easily from the banks. It will act as a registry where lenders can report any kind of loan default as it will be administered by the Reserve Bank of India. It keeps track of credit data of individuals and corporate borrowers on the basis of repayment history, credit outstanding and unpaid debts.

Read: Banks to protect staff with legal and financial aid for bonafide decisions

Challenges in existing credit information system

- Lack of comprehensive data

- Information available in fragmented manner

- Dependency on Self Disclosures by borrowers

- Authenticity and Reliability

- Time, dated information and cost

- Multiple Reporting

What are the recommendations of Deosthalee Committee regarding PCR in India?

The Reserve Bank of India received the recommendations of the Deosthalee Committee regarding establishment of PCR in India in April 2018. The committee suggested that:

- The Public Credit Registry (PCR) should be backed by a statute and in due course of time, RBI may mull transferring it to a separate entity

- Single Point reporting replacing multiple returns of various agencies like CIC, CRILC, CERSAI, ROC and IU etc.

- It will act as a repository for all loan contracts executed in India by all the lending organizations irrespective of the amount of the loan

- The registry will have both the positive and negative information regarding the borrowers and the same can also be accessed by the borrowers

- This registry should have the information regarding all kinds of loans of a person so that a clear picture can be understood from the information in PCR

- The reporting agencies should be very careful regarding the information provided to the central bank and in case of any violation of rules, there should be strict penalty

PCR in India: What is the way forward?

Based on the recommendations of the YS Deosthalee Committee, the Reserve Bank of India has started the groundwork for putting in place the Public Credit Registry. It will compile the information regarding all the loan accounts in India in all the lending institutions. This framework will help banks select borrowers based on the credit history and being developed by the RBI, it will also be a trustworthy source of information. The corporate borrowers will also be covered based on their total exposure to credit thereby giving their total loans under various heads from various banks.

Why is PCR required in the Indian context?

The Reserve Bank of India has floated the idea of the PCR since the cases of loan defaults in various banks in the country and on every occasion, lack of information has hurt the interests of these banks while initiating the process of recovery. That is why it has become the need of the hour to maintain all relevant information of a borrower in a single database so that it can be accessed by anybody from anywhere. At the same time, it is also important that the total credit exposure of any individual or corporate entity is known to the lender so that the borrower cannot hide anything at the time of taking a loan.

What will happen to Private Credit Bureaus or Credit Information Companies?

Model 1: A public credit registry and one or more private credit bureaus can coexist without any type of formal interaction between the PCR and PCB(s). In this case, credit institutions supply data to both PCR and PCBs. Whereas the PCR uses the information for supervisory and statistical purposes and shares data with the reporting entities, the PCBs may collect data from a variety of other sources besides the regulated credit institutions and provide a range of value added services including credit scoring to a wide range of users including the reporting entities and the borrowers.

Model 2: A PCR and PCB(s) could coexist having interaction between them. PCR acts as the single point of mandatory data receipt from all credit institutions. Credit institutions may optionally report credit information to PCBs. The PCR may also supply limited credit information to the PCBs. The PCBs may augment this core information with information gathered from other sources and provide services to credit information users based on it. Regulators may primarily depend on the PCR for information to be used for supervisory and statistical purposes.

The Public Credit Registry framework is still at the nascent stage and a lot of work needs to be done in this regard by the central bank. The proposal is a good idea on paper but proper maintenance and more importantly, reporting of information by the banks will hold the key to its success in the long term.