How to Verify geniuneness of Income Tax Returns

Income Tax Return (ITR) is the first thing banks asks for after KYC documents for any type of loan. The borrower submits copies of Income Tax Returns to the bank, which he has filed online.

As a banker, specially on credit desk, due diligence is very important for processing any loan application. Verifying genuineness of Income Tax Returns is part of the due diligence process. Because the eligibility of loan amount is often determined by looking into the past income of the applicant, it becomes important that the Income shown in copies of ITRs is actually same as that submitted to Income Tax Department.

Also Read : How to verify PAN online and How to Know someone’s PAN number

Here is the guide, how you can verify the genuineness of Income Tax Returns.

- Go to http://incometaxindiaefiling.gov.in/

- On the right panel click on ‘Login Here’

- Enter user ID, password and date of birth. User ID is PAN, but you need to ask the applicant to enter password. (It is suggested that password of the customer should not be asked, rather he should enter the same directly)

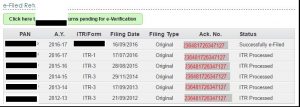

- After login, go to ‘My Account’ Tab and select ‘e-filed Returns/ Forms. It will display all the ITRs and forms filed by the person.

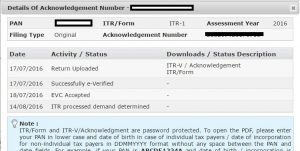

- Click on the Ack. No. of the year which you want to download. In the next screen click on ‘ITR-V’ or ‘ITR/ Form’ to download. ITR-V is one page summary and acknowledgement and ITR is detailed form, where details of income are given.

After downloading, while opening the pdf file, it will ask for password, which is pan+date of birth (for example abcd1234z01011983).

With this you can tally the copies submitted by the applicant to verify their genuineness.

Some time this part of verifying income tax returns, which is part of due diligence process is given to Chartered Accountants and Company Secretaries also. They also follow the same process give their report based on this.

You may also like – How Assessment of Term Loan is done

1 Comment

Comments are closed.