Merger of SBI & Associate Banks – Key Facts

SBI has already approved merger of its associate banks and Bhartiya Mahila Bank. Cabinate has given approval for merger of 5 associate banks with RBI, although no decision about merger of BMB.

SBI has already approved merger of its associate banks and Bhartiya Mahila Bank. Cabinate has given approval for merger of 5 associate banks with RBI, although no decision about merger of BMB.

Here are some facts about the merger and position of SBI post merger:

Banks which will be merged with SBI:

State Bank of Travancore, State Bank of Mysore, State Bank of Bikaner & Jaipur, State Bank of Hyderabad, State Bank of Patiala and Bhartiya Mahila Bank.

Key Facts

- Biggest merger/ consolidation in Indian Banking Industry.

- Gross NPA of five associate Banks are 9.14% for quarter ending June 16.

- Gross NPA of SBI are 6.94% for quarter ending June 16.

- 5 Associate Banks of SBI reported a loss of Rs.2018 crore for the quarter ending June 16.

- Standalone profit of the SBI for the quarter ending June 16 is Rs.2521 crore

Also Read:

- 5 days working for bankers?

- SBI and PNB may move out from 11th Bipartite Settlement

- Gratuity Increase for Bankers – 6 Developments so far

Position of SBI post merger:

- SBI will be in legue of Top 50 banks in world.

- Post Merger Asset base of SBI will be 37 lac crores

- SBI’s asset base will be 5 times of ICICI Banks’s asset base

- SBI’s branch network is presently 14000+, which will increase to 21000+

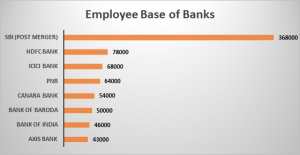

- SBI has presently around 2.94 lacs employees, which will increase to around 3.68 lacs.

- Employees of associate banks will get 15 days to decide to accept a new job with the State Bank of India or opt for voluntary retirement via an ‘option letter’

- SBI will issue its shares to the shareholders of merged banks.

1 Comment

Fotomontaże · August 9, 2022 at 5:39 am

Is there a way you can have your own blog site instead of contributing to one already made.. I have no idea how a blog works? How do you pay for it? How do you start one? Please help! It would be much appreciated! Thank you!.

Comments are closed.