Lending

What is working Capital?

Working Capital is a financial indicator of operational liquidity of a business organization. Working Capital is the short term assets…

What is Pari Passu Charge | Simple Explanation

Meaning of pari passu charge - Pari-passu is a Latin phrase, which means "equal footing". Thus pari passu charge means,…

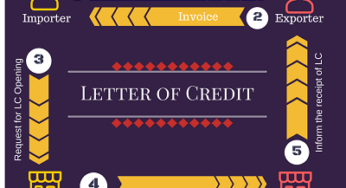

Difference between LC and SBLC – Simplified

Letter of Credit (LC) and the ‘Standby Letter of Credit' (SBLC) are used by Importers and Exporters in International Trade…

Diversion of Funds and Siphoning of Funds

What is Diversion of Funds? Diversion of Funds means (mis)utilization of Funds for a purpose for which loan was not…

CGTMSE Scheme Explained in detail [updated]

CGTMSE Scheme known as “Credit Guarantee Fund for Micro and Small Enterprises” is a guarantee fund set by Government of India…

What is Letter of Credit?

A letter of credit is issued (opened) bank a Bank on the request of his buyer customer in favour of seller, which…

Credit Appraisal Process : An Ultimate Guide for beginners

Credit Appraisal is a process which require sufficient knowledge and proper due diligence. Credit involves risk of default, which can…

What is RBI’s 5/25 Scheme?

Infrastructure and core industries projects have a long gestation periods and large capital investments. The repayment period for loans to…

Different types of mortgage – Equitable mortgage and Registered mortgage

Equitable mortgage is most common type of mortgage in India. But there are different types of mortgages. What is mortgage,…

Analysis Of Holding Period : How to : Ultimate Guide

Analysis of holding period is an important aspect while sanctioning working capital facilities in Banks. In this article, we have…

![CGTMSE Scheme Explained in detail [updated]](https://bankersclub.in/wp-content/uploads/2016/10/IMG_1672-346x188.jpg)