What is Letter of Credit?

what is letter of credit

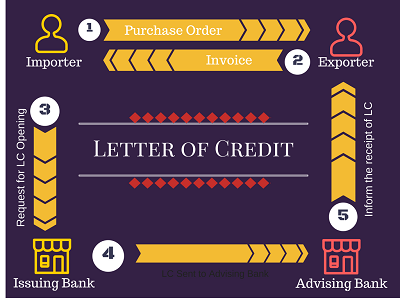

A letter of credit is issued (opened) bank a Bank on the request of his buyer customer in favour of seller, which is an undertaking by the bank to make payment to the seller if fulfills his obligations. The process of Letter of Credit is described in the following images and also explained in simple terms below:

Why the need of a letter of credit arises?

To understand the process, suppose Mr. A (importer) in India is importing goods from Mr. X (exporter) of USA. The risk to exporter is that Mr. A might not make payment of delay payment, once goods are shipped to him. Similarly, if importer makes an advance payment, risk to him is that the exporter might not ship goods once he make payment. The solution to this problem is Letter of Credit.

- The importer (Mr. A) will approach his bank (say ABC Bank) to open Letter of Credit in favour of the exporter (Mr. X).

- ABC Bank will open letter of credit and send the information to the advising Bank (A Bank in the country of exporter, say XYZ Bank).

- XYZ Bank will inform the exporter about receipt of LC. Exporter is now assured of payment.

- Exporter will ship the goods to Mr. A and submit the necessary documents to advising Bank (XYZ Bank).

- XYZ Bank in turn will send the documents to ABC Bank, who’ll make the payment to exporter.

- ABC Bank will now handover the documents to importer (Mr.A) who can get his shipment now.

- The importer will make payment to bank, in respect of LC (for which bank has already made payment) immediately to Bank, if on DP basis or otherwise on due date if on DA basis.

Letters of credit is mostly used in international trade (import/ export). But is also used in domestic trade. LC used in international trade are called Foreign Letter of Credit (FLC) and domestic ones are known as Inland Letter of Credit (ILC).

Also Read:

Recent Posts

Vacancies for CGM, GM, DGM and AGM increased in all Public sector banks.

Finance minister has approved revision in CGM level post in public sector banks. Earlier, the…

What is working Capital?

Working Capital is a financial indicator of operational liquidity of a business organization. Working Capital…

What is Pari Passu Charge | Simple Explanation

Meaning of pari passu charge - Pari-passu is a Latin phrase, which means "equal footing". …

Simplified Turnover Method for working capital assessment: FAQs

The Simplified Turnover Method is normally used by banks in order to assess the working…

Difference between LC and SBLC – Simplified

Letter of Credit (LC) and the ‘Standby Letter of Credit' (SBLC) are used by Importers…

Punjab National Bank Doubles Diwali Gift for Employees

Punjab National Bank (PNB) has announced a Diwali surprise event for its employees. To express…