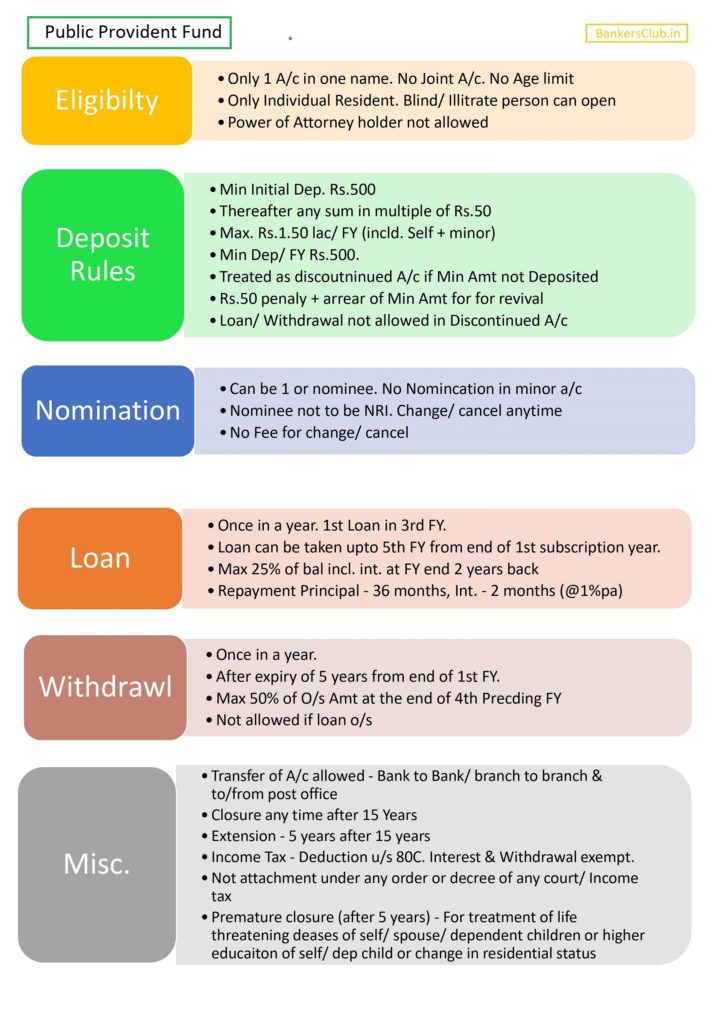

PPF Scheme Summary

This is summary of Public Provident Fund (PPF) Scheme covering major features of the scheme summarized in one picutre.

| Eligibilty | •Only 1 A/c in one name. No Joint A/c. No Age limit •Only Individual Resident. Blind/ Illitrate person can open •Power of Attorney holder not allowed |

| Deposit Rules | •Min Initial Dep. Rs.500 •Thereafter any sum in multiple of Rs.50 •Max. Rs.1.50 lac/ FY (incld. Self + minor) •Min Dep/ FY Rs.500. •Treated as discoutninued A/c if Min Amt not Deposited •Rs.50 penaly + arrear of Min Amt for for revival •Loan/ Withdrawal not allowed in Discontinued A/c |

| Nomination | •Can be 1 or nominee. No Nomincation in minor a/c •Nominee not to be NRI. Change/ cancel anytime •No Fee for change/ cancel |

| Loan | •Once in a year. 1st Loan in 3rd FY. •Loan can be taken upto 5th FY from end of 1st subscription year. •Max 25% of bal incl. int. at FY end 2 years back •Repayment Principal – 36 months, Int. – 2 months (@1%pa) |

| Withdrawl | •Once in a year. •After expiry of 5 years from end of 1st FY. •Max 50% of O/s Amt at the end of 4th Precding FY •Not allowed if loan o/s |

| Misc. | •Transfer of A/c allowed – Bank to Bank/ branch to branch & to/from post office •Closure any time after 15 Years •Extension – 5 years after 15 years •Income Tax – Deduction u/s 80C. Interest & Withdrawal exempt. •Not attachment under any order or decree of any court/ Income tax •Premature closure (after 5 years) – For treatment of life threatening deases of self/ spouse/ dependent children or higher educaiton of self/ dep child or change in residential status |