Knowledge Hub

Difference between LC and SBLC – Simplified

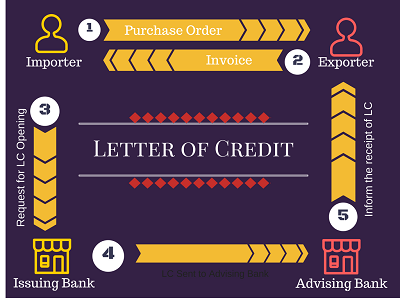

Letter of Credit (LC) and the ‘Standby Letter of Credit’ (SBLC) are used by Importers and Exporters in International Trade to ensure financial safety so that payment of the supplier is assured of payment once he has performed his obligation. While LC is used as a primary method of payment, Read more…